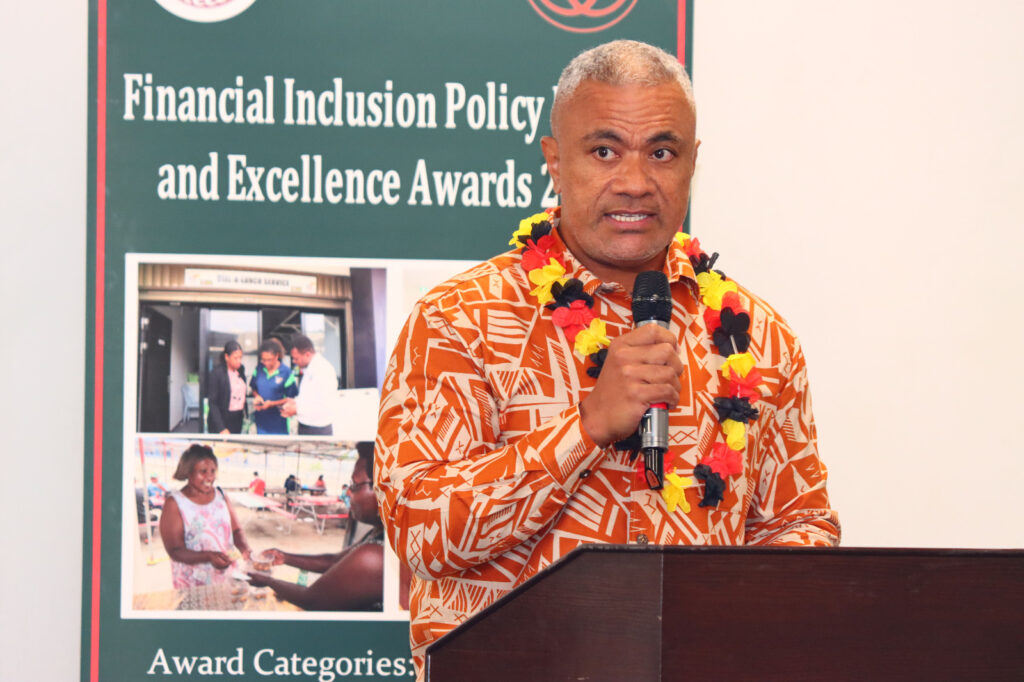

THE Bank of Papua New Guinea (BPNG) and the Centre for Excellence in Financial Inclusion (CEFI) successfully hosted its inaugural Financial Inclusion Policy Forum and Excellence Awards on Friday November 22 at the APEC Haus in Port Moresby.

Speakers at the forum included Governor of the Bank of Papua New Guinea (BPNG) Ms. Elizabeth Genia, BPNG Assistant Governor, Financial System and Stability Group, Mr. George Awap, CEFI Executive Director Mr, Saliya Ranasinghe, Alliance for Financial Inclusion (AFI)¬¬ Director of Policy Programs and Implementation, Dr. Eliki Bolewata, Asian Development Bank Country Director Mr. Said Zaidansyah and Deputy Secretary of the National Planning and Monitoring Department Mr. Michael Kumung.

Other speakers included representatives from international development partners, PNG government department heads and senior officials, partner financial institutions, members of NGOs and other stakeholders.

Governor of the Bank of Papua New Guinea Ms. Elizabeth Genia, who is also chair of CEFI’s Board, in her opening keynote address at the forum stated that the inaugural financial inclusion policy forum marked a significant step in the country’s journey towards building an inclusive, resilient and equitable financial system for all Papua New Guineans.

“The forum is not just an opportunity to discuss theoretical causes and effects. Yes, it is of real value to learn from the past achievements and to set future goals.”

“Today is also a wonderful opportunity to exchange ideas, to share best practices, to network and forge new alliances, however we must remember, first and foremost, that we are talking about real people.”

“Financial Inclusion is not just about numbers. It’s about real life. Real families. Real communities. It’s about empowering a mother to save her child’s education. It’s about enabling a farmer to invest in better tools. It’s about providing a way for small business owners to expand their operations.”

“Our responsibility is to ensure every Papua New Guinea has the opportunity to participate in and contribute towards and benefit from the nation’s growing economy,” stated the Governor.

Alliance for Financial Inclusion Director of Policy Programs and Implementation, Dr. Eliki Bolewata, thanked BPNG’s support to AFI’s network over the last 15 years.

“We appreciate the Bank’s contribution greatly and I look forward to our continued collaboration,” stated Dr. Bolewata.

Dr. Bolewata also stated that AFI was pleased to support PNG in developing a ground breaking inclusive green finance policy which was launched in 2023.

“Now we stand ready to support the work of the Green Finance Centre which is bringing that policy to life. We have already learned a lot from Papua New Guinea’s inclusive approach to greening its financial system, and we look forward to following the next stage of the journey,” Dr. Blewata added.

Further the forum breaks up for panel discussion, the panels was made up of field experts, who shared skills and knowledge on range of topics, the Technology Innovation, Green Finance, Inclusive Gender Finance to decentralized approach for Financial Inclusion – Provincial Government Engagement as well as the progress of the PNG’s Financial Inclusion Strategy 2023-2027.

The forum concluded with the Excellence Awards ceremony celebrating achievements in seven categories, Financial Inclusion and Deepening Award, Financial Innovation Award, the Inclusive Green Finance Award, Financial Inclusion Media Contribution Award, Financial Inclusion Advocate Award, and the Provincial Engagement Award.

Winners from each category were judged by a panel of independent judges from the University of Papua New Guinea, PNG National Research University, IBS University and the Bank of Papua New Guinea.

Micro banks, MiBank and Women’s Micro Bank were recognized for their outstanding achievements in the field of financial innovation, Bank South Pacific was awarded the Financial Inclusion and Deepening Award while ANZ took out the Inclusive Green Finance Award and locally owned newspaper company Sunday Bulletin was awarded the Financial Inclusion Media Contribution Award.

Provincial governments from Milne Bay and West New Britain were joint winners of the Provincial Government Engagement Award and the Financial Inclusion Advocate Award winner was Lilly Namuru – Shualink PNG Limited, Milne Bay Province.

The Bank of Papua New Guinea and CEFI have partnered to provide sponsorship for the Financial Inclusion and Deepening Award, the Financial Innovation Award, and the Inclusive Green Finance Award.

The winners of these three awards will be sponsored to attend and participate in the Alliance for Financial Inclusion Global Policy Forum in Namibia in 2025.

“This valuable sponsorship will give the winners the opportunity to meet, network, learn from and share ideas with financial inclusion participants in other countries. We also anticipate that such sponsorship opportunities will provide a strong incentive into the future for other local financial institutions to adopt and model best practices, as well as to drive financial inclusion activities in Papua New Guinea,” the BPNG Governor stated during her congratulatory remarks to the award winners.

“You are actually our outstanding ambassadors and the true champions for financial inclusion principles and practices, and are true champions for Papua New Guineans who are yet to have fair and reasonable access to financial services,” Ms. Genia told the award recipients.

The Governor concluded by thanking CEFI for organizing and hosting the inspiring policy forum and excellence awards.