THE Centre of Excellence in Financial Inclusion (CEFI) continues its undivided commitment to communities through its numerous programs of financial literacy awareness programs as well as workshops in upskilling Papua New Guineans with knowledge to making wise economic decisions.

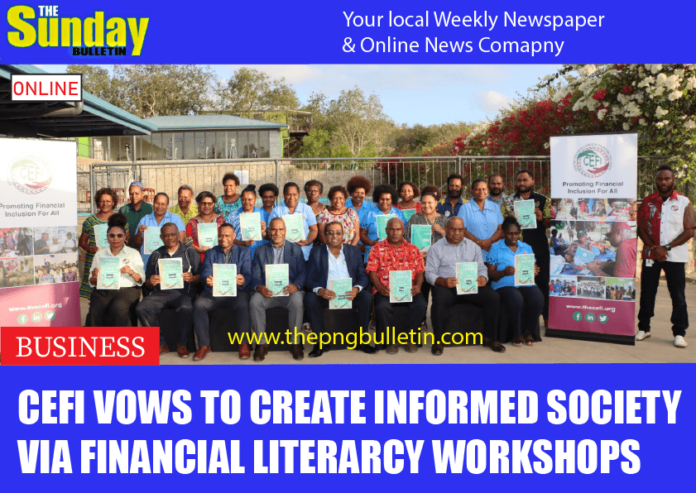

In their recent financial education workshop held at Tuhava resort last week, a total of 25 content writers participated in the two weeks workshop which targeted financial education for children doing prep up to grade six.

CEFI Executive Director Saliya Ranasinghe says he was pleased to observe the drive and effort shown by the content writers which are evident of their commitment to helping to build a better future for the country.

“I personally feel that if this country can introduce financial literacy and our people can manage their money better, this place is going to be a wonderful place to live” Ranashinghe said.

He said the primary goal of the workshop was to develop contents, basically 14 books which are the seven activity resource books, as well as the activity books for the preparatory to the grade 6.

“This is a very important endeavor because this is the foundation to empower people, especially the students to make informed decisions in all their economic activities”.

The next phase of the financial education program will see 40 schools in all the regions to receive the material which will go through a two-year pilot testing period and then allow for a revisit at the material upon feedback obtained from each school.

CEFI has a solid background in this workshop and project which they are undertaking as they have a good collaboration with the Alpha Toons, an international partner from the Dutch which they have a record of delivering financial education program to schools in over 18 countries.

“So, they are bringing the international best practice to PNG and we can assure you that our material will be one of the best in the world,” he added.

Furthermore, future programs will feature inclusion of developing content materials as well for grade seven up to grade 12 with more advocacy program of digital banking setup together with insurance schemes, superannuation, and retirement savings.

“We can make our children practice this knowledge and build a very strong future”, Mr. Ransinghe remarked.