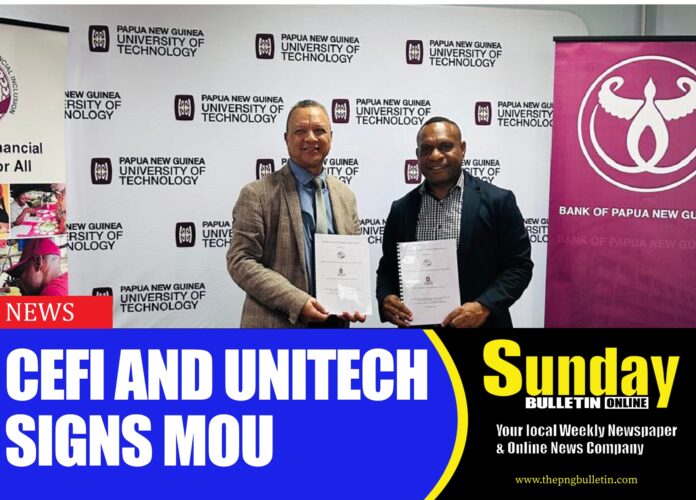

The Centre for Excellence in Financial Inclusion (CEFI) and the Papua New Guinea University of Technology (Unitech) have formally signed a Memorandum of Understanding (MoU) to establish a Fintech Incubation Centre at Unitech’s campus in Lae.

The new Fintech hub will play a crucial role in supporting the development and growth of financial technology startups. It will provide mentorship, funding, networking opportunities, and access to industry expertise. The initiative aims to foster innovation within the financial services sector by helping entrepreneurs refine their business models, develop products, and navigate regulatory requirements. Furthermore, the hub will facilitate collaboration between fintech startups, the Bank of Papua New Guinea’s regulatory sandbox, and established financial institutions, thereby promoting the integration of new technologies into traditional banking and finance systems.

The main goal is to accelerate the growth of fintech entrepreneurs and enhance the broader ecosystem of financial payments and service systems, ultimately expanding financial inclusion across Papua New Guinea.

Unitech Vice-Chancellor, Professor Ora Renagi OL, stated that “learning transforms living standards.” He emphasized that this initiative would empower young IT professionals to develop innovative solutions capable of enhancing a wide range of industries throughout the country.

Professor Renagi further elaborated that the University’s focus on teaching and research, as well as its five-year strategic plan, identifies the establishment of centres for innovation and incubation as a priority. He described the partnership with CEFI to establish the Fintech Incubation Centre as both timely and supportive.

CEFI’s Acting Executive Director, Mr. Peter Samuel, reiterated CEFI’s commitment to advancing financial inclusion by embracing innovation and technology. He noted that the partnership would not only improve financial services but also create opportunities for students to become self-employed and contribute meaningfully to economic development.

Mr. Samuel also highlighted that fintech solutions developed through the Centre would be tested in the Bank of Papua New Guinea’s regulatory sandbox before their broader market introduction, ensuring compliance, safety, and effectiveness.

Following the MoU signing, attendees visited the proposed site for the Fintech Incubation Centre, marking a significant step towards realizing this transformative vision.

Supporting this initiative are the PNG ICT Cluster and the National Information and Communications Technology Authority (NICTA). Key stakeholders are eager to collaborate to bring transformative changes to the financial services landscape, ensuring that financial systems become more efficient, inclusive, and accessible to individuals in both urban and rural areas.